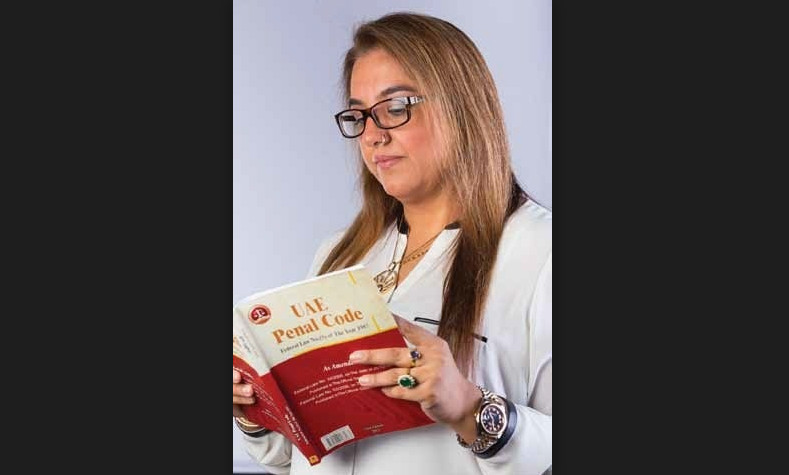

Our Consulting Editor, Advocate Anjana Bhatia D.I is an accomplished Indian Lawyer practicing in India and the UAE. She has over 25 years of experience in Law – Litigation, Corporate, Civil, Criminal, Mediation as well as registered with DIFC Wills and Probate Registry. She provides legal solutions to clients globally with strategic results.

Adv. Anjana Bhatia D.I. speaks EXCLUSIVELY to Emirates Reporter on : Tax Exemption of Non-Commercial Sports Entity

E.R- In what way does Cabinet Decision No. (1) of 2026 reinforce the UAE’s strategic approach to regulating and supporting the sports sector?

ADV. ANJANA- Cabinet Decision No. (1) of 2026, promulgated under Federal Decree-Law No. 47 of 2022, represents a strategic refinement of the UAE’s corporate tax regime as it applies to the sports industry. Rather than excluding sports entities from the tax framework altogether, the decision introduces a structured and conditional exemption for organisations operating strictly on a non-commercial basis.

This approach ensures that eligible entities remain within the broader regulatory and compliance environment while benefiting from targeted relief aligned with public-interest objectives. By linking exemption status to governance standards, purpose limitation, and oversight requirements, the decision promotes transparency, financial discipline, and institutional accountability.

E.R- How does this exemption interact with the broader UAE Corporate Tax framework?

ADV. ANJANA- The exemption functions as a structured adjustment within the framework of Federal Decree-Law No. 47 of 2022 rather than a blanket exclusion from the corporate tax regime. Qualifying sports entities remain within the regulatory scope of the law and must formally apply to the Federal Tax Authority to obtain exempt status, ensuring oversight and compliance. By limiting relief to organisations operating strictly on a non-commercial basis and confining activities to their core sporting objectives, the decision preserves the integrity, transparency, and neutrality of the UAE’s corporate tax system while providing targeted support to genuine public-interest sports bodies.

E.R- How might this decision impact the long-term sustainability of sports institutions in the UAE?

ADV. ANJANA- The decision provides targeted corporate tax relief to qualifying non-commercial sports entities, allowing organisations to reinvest resources into critical areas such as athlete development, infrastructure, grassroots programs, and international competitions. It also enhances institutional stability and governance by establishing a predictable regulatory environment, encouraging long-term planning and strategic growth. Over time, this strengthens operational resilience, raises competitive standards, and supports the UAE’s broader objectives of building a sustainable, globally competitive sports ecosystem while contributing to economic diversification and national development.

E.R- How does this exemption contribute to the UAE’s vision of becoming a global sports hub?

ADV. ANJANA- The exemption serves as a strategic policy lever to position the UAE as a premier destination for international sports. By offering a clear and supportive tax framework for non-commercial sports entities, the country becomes more attractive to global federations, professional associations, training academies, and event organisers. This reduces financial barriers, allowing international organisations to establish operations, host tournaments, or conduct training programs in the UAE. Over time, such engagement not only raises the standard of domestic sports but also enhances the nation’s visibility and reputation on the global stage. Combined with investments in infrastructure, governance, and athlete development, the exemption strengthens the UAE’s ability to host world-class events, promote elite-level competition, and integrate into international sporting networks aligning fiscal policy with the broader goal of establishing the country as a leading global sports hub.

E.R- How might the exemption influence the growth of community and grassroots sports in the UAE?

ADV. ANJANA- The exemption enables non-commercial sports entities to dedicate a larger share of their resources to community outreach, youth development, and grassroots programs. By reducing the tax burden, organisations can expand training academies, organise local competitions, and implement educational initiatives that nurture emerging talent from an early age. This not only strengthens talent pipelines for professional and national-level sports but also promotes wider participation, inclusivity, and a culture of physical activity across communities. Over time, such investments help establish a strong and sustainable foundation for the UAE’s sports ecosystem, ensuring long-term sectoral growth and societal engagement.

E.R- In what ways does the corporate tax exemption enhance the social and community impact of sports in the UAE?

ADV. ANJANA- The corporate tax exemption empowers non-commercial sports entities to channel more resources into initiatives that go beyond competitive sports, including community outreach programs, health and wellness campaigns, educational workshops, and inclusive activities targeting underrepresented groups. With reduced fiscal pressures, organisations can expand these programs, fostering greater participation, promoting healthy lifestyles, and building stronger community engagement. Over time, such initiatives enhance the societal value of sports, encourage social cohesion, and align the sector with the UAE’s broader objectives of community development, youth empowerment, and national well-being, ensuring that the growth of sports contributes meaningfully to social progress.

“The above is a general overview; outcomes differ from case to case and are subject to the discretion of the concerned authorities.”

ADVOCATE ANJANA BHATIA D.I CAN BE CONTACTED AT-

Mobile: +971505944896

Website: www.ajureadvocates.com

Email- anjana@ajureadvocates.com